Posted on |

Is It A Right Time To Upgrade To A Landed Houses?

Many property investors regard landed houses as the pinnacle of asset progression because they are considered the most prestigious class of property. They do behave, unlike many other property assets. My case in point? A record number of landed homes sold during this Covid-19 period.

As of Q3 2020, landed home sales volumes are up by a phenomenal 50 per cent. The sales numbers stood at 544 transactions, up from just 212 in Q2. This was actually the strongest showing since 2018, despite the fact we’re in the middle of a pandemic, and one of Singapore’s worst economic contractions.

To those who aren’t familiar with landed properties, this can seem contradictory: why would buyers purchase the most expensive properties, in a time of economic volatility?

To those who know Singapore’s landed property market, however, the answer is quite simple: now may be the time to purchase, precisely because of economic volatility. Here’s why landed properties are going full steam ahead:

How do landed properties perform compared to other properties?

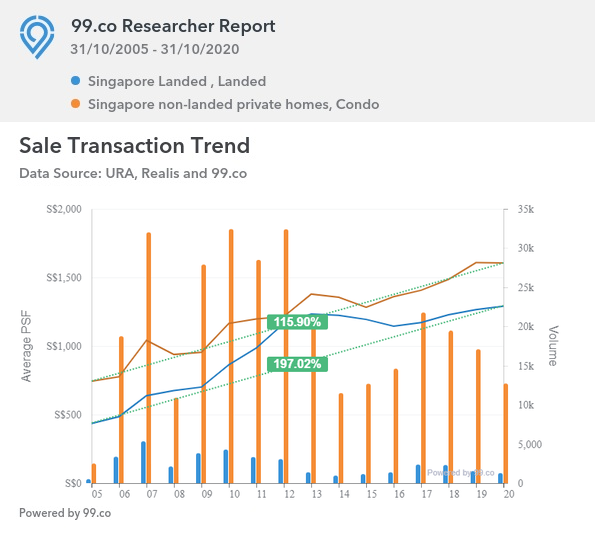

Landed homes prices have risen 197 per cent over the past 15 years (October 2015 to October 2020). The average price has risen from $434 psf to $1,290 psf.

In comparison, private non-landed homes (excluding Executive Condominiums) have appreciated only 115.9 per cent in the same time; from an average of $744 to $1,606 psf*.

I would like, however, to highlight the difference between freehold and leasehold landed properties. The disparity between these two is wider in the landed segment than in the condo segment:

Over 15 years, freehold landed home prices have appreciated around 200 per cent, from $467 to $1,401 psf. At the same time, leasehold landed homes have appreciated 164.6 per cent, from $332 to $878 psf.

In particular, note that leasehold landed homes have seen a general dip since 2017, whereas freehold landed homes have continued to rise in price. This indicates a preference for what some buyers call “true landed” properties; that is, landed homes such as bungalows on a patch of freehold land, rather than strata-titled homes (you may find these types of landed homes within 99-year leasehold condos).

In the recent surge of landed home purchases, 468 of the 544 transactions were freehold landed properties. Only 76 were strata-titled.

*Note that larger properties tend to have a lower price per square foot, although their quantum or overall price is much higher. In terms of quantum today, the average condo price is around $1.5 million, while the average landed home is about $4.2 million.

What makes the landed property market different?

The most immediate answer is scarcity. In a country as small as Singapore, land will always be at a premium. There is little room for low density housing in Singapore, and thus landed properties make up the smallest market segment.

As of 2018, there were an estimated 210,000 condo units in Singapore. By contrast, there were only 68,000 landed properties. Of these, the pinnacle of landed properties – the Good Class Bungalow or GCB – number a mere 2,800 (and some of them, like the famous Black and White bungalows, can’t even be purchased; they’re operated and rented out by the government).

Conservation shophouses, which can also be considered landed homes if residential, numbered only about 6,500.

It is quite likely that the number of landed homes today are mostly unchanged from 2018, as this is the slowing growing segment in terms of supply. There is a simply a lack of space in Singapore for such low-density housing; and only a small number of buyers who have the means to afford them.

How does this make 2021 an attractive time to purchase landed properties?

- Landed homes are a safe haven asset during downturns

- Low-interest rate environments make landed homes attractive

- Protection from inflation rate risks

Landed homes are a safe haven asset during downturns

The last Global Financial Crisis began in 2008. At the time, Singapore became the first Asian country to slip into recession. However, take a look at the price movement of landed homes starting from the time of the crisis:

After a brief dip between ’08 and ’09, the landed home market rebounded and rose about 43.7 per cent by 2012 ($708 to $1,039 psf).

This is a similar pattern to what we’re seeing in 2020: the crisis seems to drive investors into the landed property market, rather than away from it. Will this pattern continue in 2021?

This is a similar pattern to what we’re seeing in 2020: the crisis seems to drive investors into the landed property market, rather than away from it. Will this pattern continue in 2021?

Low-interest rate environments make landed homes attractive

Home loan rates in Singapore are currently at all-time lows, with many loan packages hovering at about 1.3 per cent per annum.

This is because, during times of crisis, governments take stimulus measures to drive the economy. Probably the most important one to Singapore is the US government: when the United Stated Federal Reserve slashes interest rates, Singapore is also affected. This results in the Singapore Interbank Offered Rate (SIBOR) falling, which in turn reduces the interest rate on home loans.

At this point, the US intends to keep rates at near zero until 2023. They will not suddenly jack up the rate after that, as doing so could cause more economic damage; rather, the US tends to gradually increase rates over the years.

The last time they slashed rates in 2008, home loans in Singapore became cheaper than HDB loans (2.6 per cent) – and the rates have stayed that low until now (when Covid-19 send them crashing down again).

The low rates are an incentive to property buyers, who can easily beat the 1.3 per cent interest. After all, even their CPF provides a guaranteed 2.5 per cent interest.

Protection from inflation rate risks

The threat of stimulus measures is out-of-control inflation. When interest rates are suppressed for a long time, the general cost of goods tends to increase (people spend more when there’s less reward for keeping money in the bank, and loans are easier to come by).

As such, investors will seek out returns that can keep pace with the rate of inflation. Precious metals are a common choice; but another one is – you guessed it – property. As the cost of goods go up, your home value will rise alongside it (whereas your cash would stagnate).

Coupled with their scarcity, this makes landed property a good way to protect against inflation rate risks.

Besides these, there are many “soft” factors that drive upgraders into landed homes

A landed home can offer features that no condo can.

Through Additions & Alternations (A&A), a landed home can be fully customised from the façade to the interior*. Driveways, backyard, patios, roof terrace, pool etc. can all be tailored to your exact lifestyle and aesthetics; and there’s no “management committee” to stop you.

Freehold landed homes, in particular, are among the ultimate multi-generational assets. A true landed home means owning the land under the house as well; and this has value long after the property on it has been torn down, rebuilt, etc. This can serve as a source of income for children, grandchildren, and so forth down the line. And as Singapore is small and the population continues to grow, the land value can only appreciate. The supplies of landed houses don’t multiply like condos.

As an aside, conserved landed homes – while more restrictive – are also well protected. The government is unlikely to bulldoze a precious conserved building to put a road through it!

*Barring specially conserved properties, like certain shophouses or Good Class Bungalows.

While 2021 looks like a good time to enter the landed homes market, it isn’t for everyone.

There is no universally correct method to property investment – your decisions must fit your individual financial situation.

For example, landed homes may not be ideal if your aim right now is to chase rental income; a shoebox condo unit, or even a resale flat, is sure to outperform a landed property.

The quantum of landed property is so high, that rental yields are almost always on the low-end; and this is not its main strength as a property asset (barring a few select shophouse properties).

Likewise, you should consider the type of landed home that suits you. A semi-detached house, for instance, can be a more cost-effective option than a Class 1 bungalow. It may also be better to save up a bit, to get a true landed property, rather than a strata-titled home.

This all comes down to getting the right budget and having clear financial goals for your property.

If you’re ready to make the move into landed homes or are thinking about it, do contact me for help – together we can see where it would fit (or not fit) in your wealth journey.

And if you feel you could never afford a landed home, well, you may be underestimating yourself.

With property wealth planning, many families have moved from flats to condos to landed homes or penthouses; some over a few generations, some in just a few decades. Do reach out if you’re interested, and I can help you plan such an asset progression path. You can use the calendar below to schedule a virtual meeting.

Danny Han has always been in the people’s business, having spent 23 years as a church pastor, five years as an insurance agent, and the last 16 years as a property consultant.

Danny has a genuine interest in people and firmly believes in personal integrity. While helping homeowners with their property needs, their interest always takes precedence over his personal gains. Hence, Danny has consistently earned his clients’ complete trust and loyalty. Many of them have become his personal friends.

Danny received his Diploma in Mechanical Engineering from Singapore Polytechnics and Bachelor of Science from Oklahoma Christian University of Science and Arts in Bible & Psychology.

Besides keeping abreast of the property market trend and constantly equipping himself to better serve his clients, Danny is a passionate foodie, a weekend cyclist, and an avid hiker.

Is It Still Worth Buying A Freehold Property For Retirement?

How Your Property Can Still Provide For Retirement In 2023 And Beyond

Subscribe to receive updated practical property investment insights, property reports and good investment deals

Leave a Reply