Posted on |

Is Your HDB Flat A “Retirement Asset”?

What is the most significant change in Singapore’s property scene today?

If you ask most people, they may say it’s higher prices, a growing population, smaller home. The most up-to-date market watchers will even tell you about supply overhang or the Covid 19 pandemic. But actually, the most significant change that we should be paying attention to is in the role of the HDB flat. Many Singaporeans are still counting on their HDB flats, but is your HDB flat still a retirement asset today?

Here’s why:

More often, we see Singaporeans offloading their HDB flats as soon as they fulfil the Minimum Occupancy Period (MOP)

For 2019, the sale of newer HDB flats hit a nine-year high. According to a recent Straits Times report on 30 Jan 2020, 4,578 newer flats were sold in 2019 – this is up by more than a third from 2018.

What’s The Hurry To Sell?

Now when we say “newer flat”, this is industry parlance for HDB flats that are 10 years old or newer. A surge in the sale of newer flats typically indicates a rising number of upgraders. That is, HDB owners who are selling after the five-year Minimum Occupancy Period (MOP), and moving on to a private condominium or Executive Condominium (EC). In some cases, they sell one HDB and buy two condos.

Why are people in a hurry to sell? What’s changed from the days when many HDB owners held on to their flats for much longer (often even until retirement)?

The answer lies in the weaker appreciation of HDB resale flats.

Why are people in a hurry to sell? What’s changed from the days when many HDB owners held on to their flats for much longer (often even until retirement)? The answer lies in the weaker appreciation of HDB resale flats.

If you bought a HDB resale flat a long time ago (between 2007 and 2013), here’s the first thing I need to update you on: the days of sky-high Cash Over Valuation (COV) are long over. In fact, as far back as the year 2016, some 80 per cent of resale flats were transacted with zero COV.

There are still some ‘million-dollar flats’ for sure; but these are the exceptions and not the norms.

HDB Resale Flat Prices Historical Trend

Moving on, let’s take a look at how resale flat prices have moved over the decade. The average price of an HDB flat island-wide, over the past 10 years, has appreciated from around $379 psf, to about $415 psf.

The average price of resale flats, over the same period, has gone from around $390,000 to about $431,000 – an appreciation of 10.75 per cent.

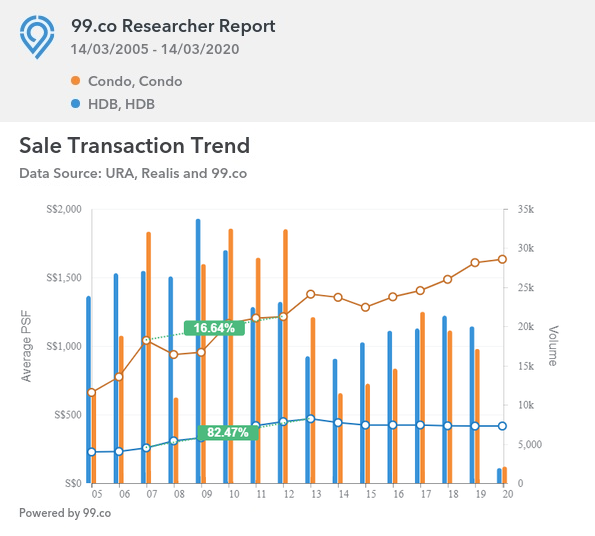

Here’s a visual depiction, made from the research tool on the property portal 99.co (it’s based on URA / Realis data):

As you can see, HDB resale prices have mostly declined or remained flat since 2013.

Why did prices drop since 2013?

Impact Of Cooling Measures On HDB Resale Flat Prices

The HDB resale market was red hot up from 2007 to 2013 when prices went up by 82.47%, which way out-performed the 16.64% gain made by private condos. The sentiment shared by both Singaporeans and PRs then was you could do no wrong with investing in HDB flats.

MSR, CPF Cap and PR Restrictions Affect HDB Resale Flat Prices

In an attempt to cool the market, the government introduced a few cooling measures in 2013, some of which targeting specifically at the runaway HDB market:

- Mortgage Servicing Ratio (MSR) which is a limit imposed by the MAS on how much money you can borrow when you take out a loan to buy HDB flat or EC. Under the MSR, a maximum of 30% (35% if taking HDB loan) of your gross monthly income can be used to repay your bank loan (including all debts).

- Singapore PRs are not allowed to sublet the whole flat. They must sell within 6 months if they buy private properties.

- Limit on the use of CPF for flats that have less than 60 years remaining tenure.

What these cooling measures mean is the amount of loan eligible became lesser.

The demand by Singapore PRs for HDB resale flats also dropped considerably because they no longer see them as viable investment properties.

Home buyers also stayed away from older HDB resale flats with less than 60 years remaining lease.

Subsequently, from 2013 HDB resale prices have dropped by 11.26%, as compared to a 18.48% gains by private condos.

HDB Flats That Are More Than 40 Years Old Are Badly Affected

The cap on CPF for older HDB resale flats more than 40 years old made the majority of flats in the matured estates, which were built in the 1960s and 1970s, less desirable. About 90,000 flats are more than 40 years old. This problem became more and more acute in the coming years until the government had to tweak the policy on 10 May 2019 to the usage of CPF.

So if you had bought your resale flat between 2011 to 2013, you would likely suffer a loss.

So if you had bought your resale flat between 2011 to 2013, you would likely suffer a loss.

The Idea Of HDB Flat Values That “Will Never Fall” Is Fast Disappearing

In the past, many Singaporeans didn’t take the idea of lease decay seriously. We always assumed that, at the 99-year mark, the government would definitely give us something for our HDB flats; perhaps something like the Selective En-bloc Redevelopment Scheme (SERS).

It was only when our Minister for National Development made it clear that when the 99-year lease run out, the flats would be returned to HDB without any compensation did the bitter truth set in.

With the announcement of the Voluntary Early Redevelopment Scheme (VERS) that followed, the writing was on the wall. Most housing estates will not be “rescued” (SERS will only take place for around five per cent of HDB flats). And there’s a real chance that VERS can fail (it requires 80 per cent agreement to en-bloc), leaving you stuck in the flat until its value inevitably reaches zero.

Good News and Bad News

Now I don’t think it is an entirely bad thing, as it ensures Singaporeans from all walks of life can afford a home.

Seeing HDB flats as housing, rather than investments, keeps them affordable to future home buyers (you want your children to be able to afford a home, right?)

But it is bad news for flat owners who are banking on their HDB flats for retirement. The growing fears of lease decay, and muted appreciation of resale flats, means it may not be the retirement asset it once was.

Seeing HDB flats as housing, rather than investments, keeps them affordable to future home buyers... But it is bad news for flat owners who are banking on their HDB flats for retirement. The growing fears of lease decay, and muted appreciation of resale flats, means it may not be the retirement asset it once was.

Selling Is Not Always The Best Option

After all that has been said, I need to add in a disclaimer.

I am not advocating everyone MUST sell their current HDB flat and invest in a private property. There are situations when it is not the best option or even workable.

Retirees or Near Retirement Age

One group of owners would be the retirees or about to retire.

Without an income, and thus not eligible for a housing loan, upgrading would be an issue.

If you are in your late fifties, your bank loan tenure will be short and monthly mortgage payment will be high. It would be too stretching for an average income earner to upgrade. To grow your property wealth, it is imperative to start early.

Other Options To Unlock The Value of Your HDB Flat

There are other ways to unlock the value of your HDB flat.

- Downgrade to a smaller flat; for example, from a maisonette to a 3-room flat or a 3-room flat to a studio flat.

- Sell part of your lease to HDB through the lease buyback scheme, as long as it still has more than 20 years remaining years.

- Rent out your rooms for additional passive income, provided you don’t mind losing your privacy.

- Sublet your whole flat and stay with your children (not ideal because they should have a life of their own).

If you are in your late fifties, your bank loan tenure will be short and monthly mortgage payment will be high. It would be too stretching for an average income earner to upgrade. To grow your property wealth, it is imperative to start early.

Sublet Your HDB Flat

If you look purely at rental yield, nothing can beat the HDB flats. But of course, there are other considerations, such as the age of your flat. At some point, the rate of depreciation will be faster than your rental return.

The 40-year mark will be one factor since a cap on CPF usage may be applicable for potential buyers. It will become increasingly more difficult to sell with each passing year beyond the 40-year mark.

An Example

I have a couple who has been based in the US for many years. They have a fully paid up 45-year-old 3-room flat in the Holland area, which they rent out for $2,200 a month. In their case, I advised them not to sell even though it can still fetch about $400,000 in today’s market (they paid for about half that price).

The reason is, with the payout, they have NO PLAN TO REINVEST THE MONEY. Financially, they don’t have the means to upgrade to a condo, and they don’t invest in stocks. If they put the money in the bank, the interest is too pathetic.

In this case, the flat is their retirement asset because it generates a decent passive income for them.

Also, I know a HDB flat in the Holland area, as long as it is properly maintained, will be very rentable. And the tenant profiles are usually excellent.

Not Bothered By The Diminishing Value of Your HDB Flat

Another class of people are those who are not bothered by the diminishing value of their flats. They are contented with having a roof over their heads. They foresee they will stay in their current flats till they expire (hopefully before the lease expires).

This mindset represents the majority of Singaporeans.

There is nothing wrong with that. Contentment is one key to happiness.

However, if you are willing to explore how you can best use your home as a path to wealth and a happier retirement, do contact me.

Need an opinion on your property investment plans? Want to know the value of your property? Or need help to sell or rent out your property?

Get a 1-time free 30 min Property Wealth Planning consultation. Schedule one right now by using the calendar below .

A PWP consultation includes:

- An in-depth financial affordability assessment

- Highly relevant investment insights

- A clear and customised investment road map for your real estate investment journey ahead.

Danny Han has always been in the people’s business, having spent 23 years as a church pastor, five years as an insurance agent, and the last 16 years as a property consultant.

Danny has a genuine interest in people and firmly believes in personal integrity. While helping homeowners with their property needs, their interest always takes precedence over his personal gains. Hence, Danny has consistently earned his clients’ complete trust and loyalty. Many of them have become his personal friends.

Danny received his Diploma in Mechanical Engineering from Singapore Polytechnics and Bachelor of Science from Oklahoma Christian University of Science and Arts in Bible & Psychology.

Besides keeping abreast of the property market trend and constantly equipping himself to better serve his clients, Danny is a passionate foodie, a weekend cyclist, and an avid hiker.

Subscribe to receive updated practical property investment insights, property reports and good investment deals

Leave a Reply